Wind mitigation is a crucial aspect of home ownership, particularly in Florida where hurricanes and tropical storms are a common occurrence. The mismanagement of wind mitigation can lead to extensive damage and a significant financial burden for homeowners. Between 1980 and 2021, tropical storms and hurricanes caused an average of $1.1 trillion in the United States.

It is therefore imperative for homeowners to ensure that their homes are properly equipped to withstand high winds and other severe weather conditions. This is where the importance of wind mitigation inspection service in Brevard County Florida comes in.

Let’s explore wind mitigation by understanding its techniques and benefits. Learn how wind mitigation inspections protect homes from wind damage and how homeowners can ensure their properties are secure.

What is a Florida wind mitigation inspection?

A wind mitigation inspection is a type of home inspection that is specifically designed to assess a home’s ability to withstand high winds from a hurricane or other severe weather events. The inspection involves a thorough examination of the home’s structure, including the roof, windows, doors, and other openings.

The inspector will look for features that can help to minimize damage and increase the home’s resistance to wind damage, such as hurricane shutters, reinforced garage doors, and impact-resistant windows. Based on the findings of the inspection, the homeowner may be able to qualify for discounts on their home insurance premiums.

By identifying homes with strong wind-resistant features, insurance companies offer lower rates to homeowners who take steps to mitigate their risk of wind damage. Homeowners in Florida have three times higher insurance premiums than the national average. This is due to the increased risk of wind damage, so a wind mitigation inspection can potentially save them money in the long run.

How do I get a discount on my home insurance premium with a wind mitigation?

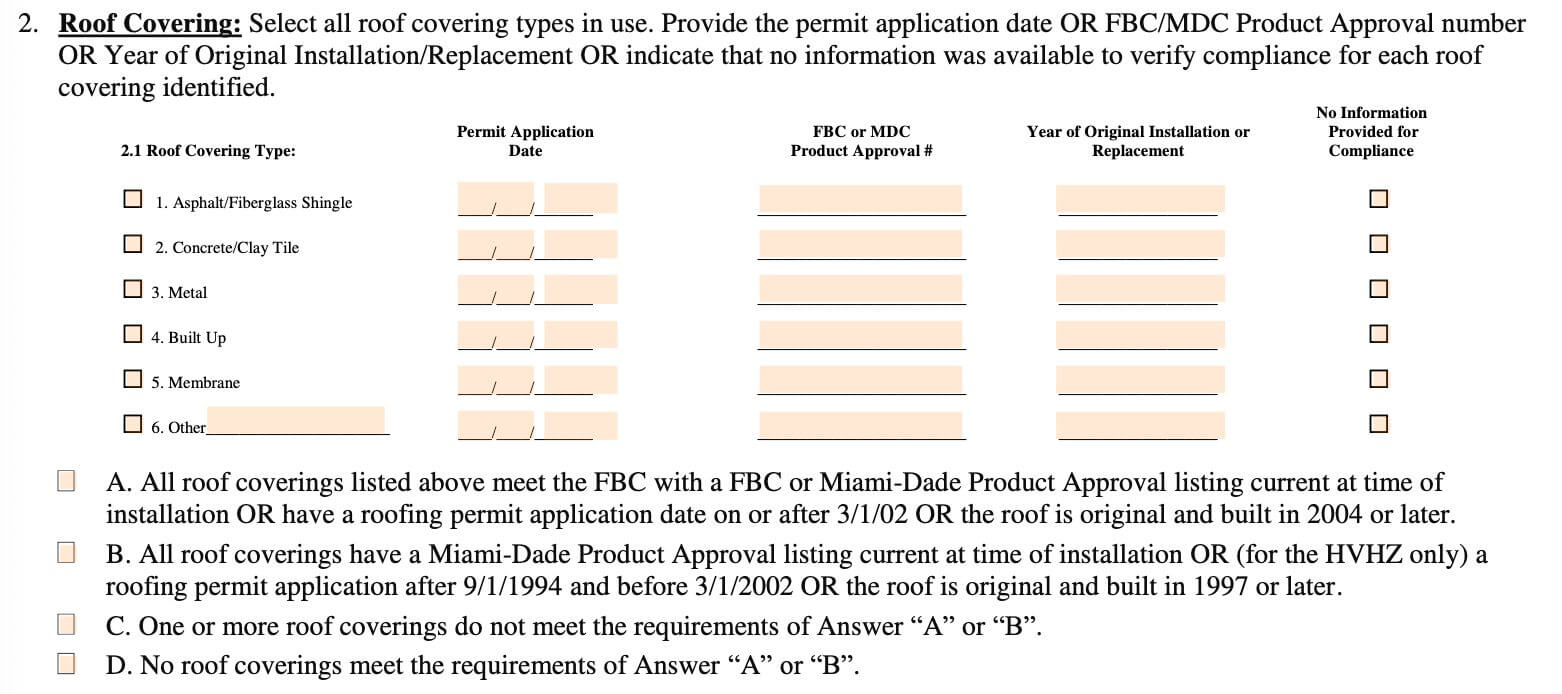

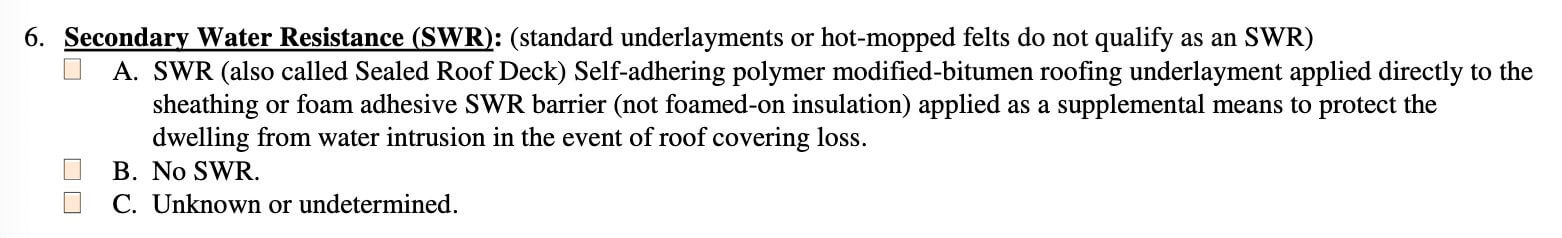

Each section of the wind mitigation inspection can affect your home insurance premium discount. Home insurance companies vary as to the discounts they provide with each wind mitigation credit. We’ve listed each section of the wind mitigation inspection and it’s potential affect on your home insurance premium discount.

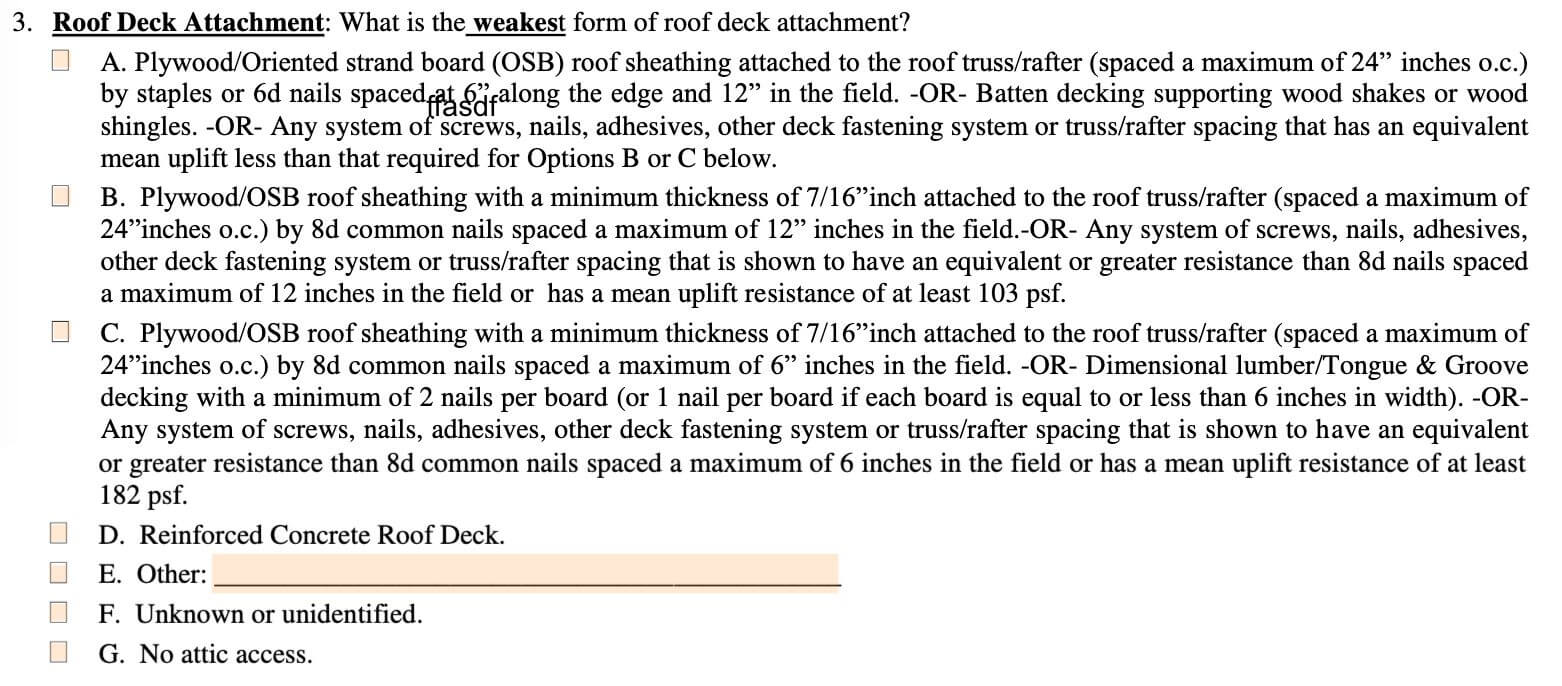

Roof deck attachment

The inspector will examine how the roof deck is attached to the roof framing, as this can have a significant impact on the home’s ability to withstand high winds. The inspector will identify the type of nails and spacing (distance) in between each nail which connects the roof with the truss or rafter. Options A-D on the wind mitigation are listed from least credit offered (A) to most credit offered (D) on your home insurance premium.

Roof-to-wall connections

The inspector will examine how the roof is connected to the walls of the home, looking for features such as hurricane clips or straps that can help to strengthen the connection. Connections listed from least credit to most credit are Toe Nails, Clips, Single Wraps, Double Wraps, and Structural (Anchor bolts or concrete roof).

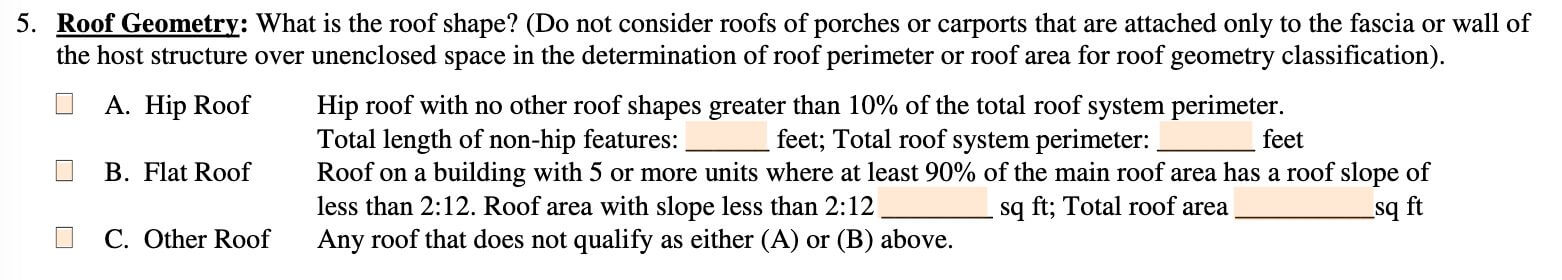

Roof Geometry

The inspector will examine the shape of the roof. This is a simple visual inspection. Most roofs in Florida are Hip, Gable, or Flat. A hip roof will offer the most credit in this section. Check out this article to view roof shape examples.

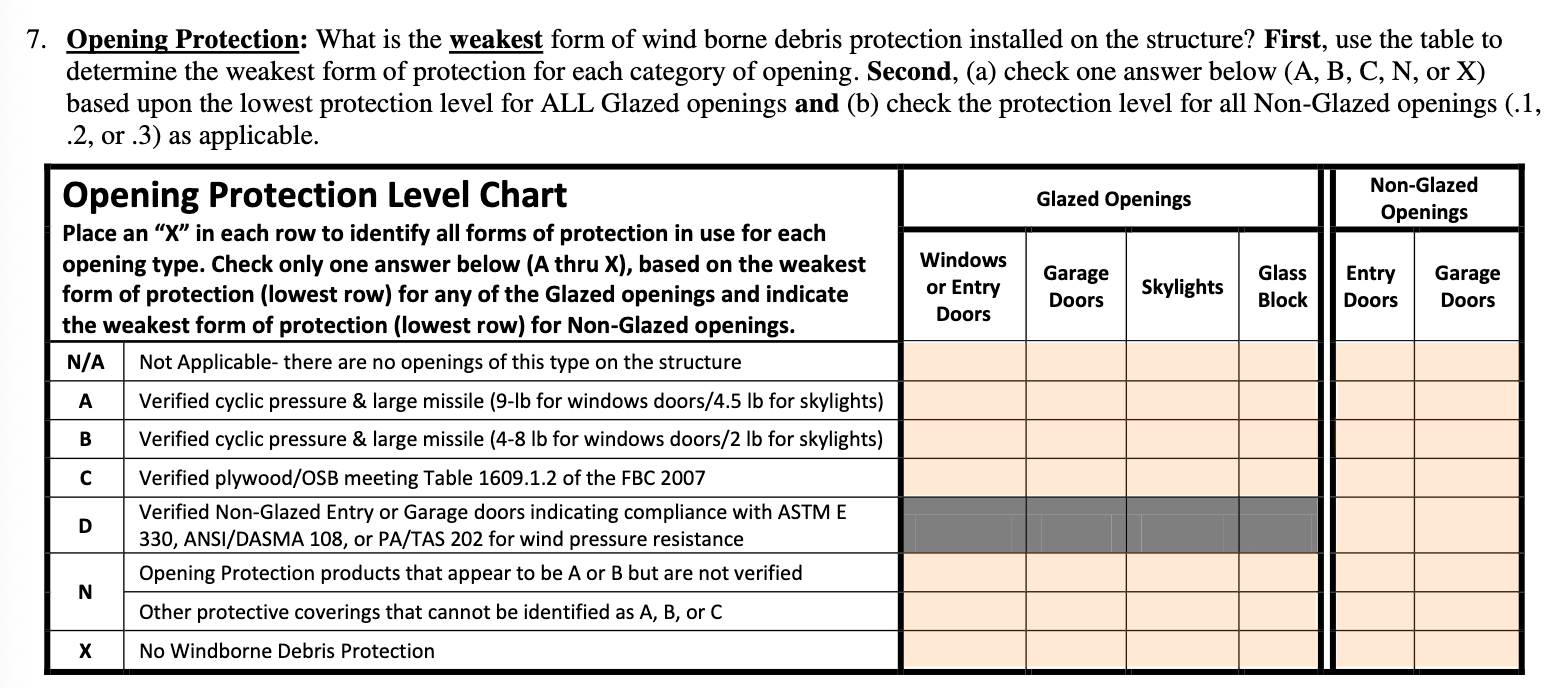

Opening Protection

The inspector will examine all exterior openings on your home. This includes windows, doors, garage doors, skylights, and glass blocks. In order to receive a discount on your home insurance premium for this section, ALL openings must be labeled with a minimum wind borne debris protection. If all openings are labeled as required, except for 1 window or door, you will not receive this credit.

Why do I need a wind mitigation inspection in Florida?

The primary reason to get a wind mitigation inspection is to receive a discount on your home insurance premium. If you get a new roof installed, you will need to get a new wind mitigation inspection. Since Brevard County is coastal and near the hurricane prone Caribbean Sea, there is a significant chance of hurricane force winds. As such, home insurance companies offer massive discounts for updating your home to better withstand these winds. This is why wind mitigations in Melbourne, FL and Brevard County are so important.

Frequently Asked Questions

A wind mitigation inspection is not a requirement in Florida. It is an optional inspection, however, it is strongly recommended because it can provides a significant discount on your home insurance premium.

Visit our Pricing page for the most up to date wind mitigation pricing. We provide a bundle discount when you get a wind mitigation and 4 point inspection completed at the same time.

Wind mitigations are typically good for up to 5 years, however, this varies based on your home insurance carrier. Some carriers will allow an older inspection so be sure to check with your insurance agent. It is recommended to get a new wind mitigation when replacing your roof as a new roof will provide an additional discount on your home insurance premium.